Unlocking the Power of Pre-Market Data: A Game-Changer for Investors

Table of Contents

- How CNBC Premarket Can Boost Your Investment Strategy » CNBC Posts

- Pre-Market Trading | Buy/Sell Stocks in Pre-Market & Post-Market Trading

- Investing Premarket: Strategies for Early Birds | FinanceFeeds

- How to Trade Pre-Market – How it Works, Benefits, and Risks

- Pre-Market Trading Guide: How to Trade During Pre-Market and After ...

- Pre-Market Trading on TradeStation - YouTube

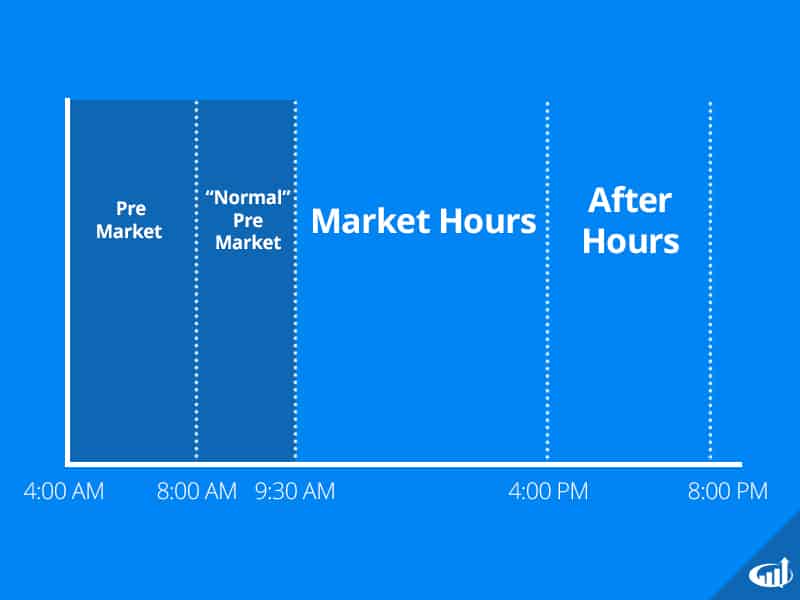

- Pre-Market Trading Hours | Investors Underground

- NSE Pre-Open Market Strategy | 100% working Strategy

- Trading Premarket and Postmarket Pros and Cons - YouTube

- What is Pre-Market Trading? Meaning, Works, Advantage & Risk

In today's fast-paced financial markets, having access to accurate and timely information is crucial for making informed investment decisions. One such valuable resource is pre-market data, which has become an essential tool for investors seeking to gain a competitive edge.

What is Pre-Market Data?

Pre-market data refers to the collection of financial market statistics and analytics available before the official opening of stock exchanges. This data provides investors with valuable insights into market trends, company performance, and industry developments, giving them an opportunity to make informed decisions before the markets open.

The Importance of Pre-Market Data

Pre-market data has become increasingly important in today's dynamic financial landscape. With the rise of electronic trading and high-frequency trading, investors need access to real-time information to stay ahead of the curve. Here are some reasons why pre-market data is a game-changer:

Timely Insights: Pre-market data provides investors with timely insights into market trends, allowing them to make informed decisions before the markets open.

Reduced Risk: By having access to pre-market data, investors can better assess potential risks and opportunities in the market, reducing their exposure to market volatility.

Informed Decision-Making: Pre-market data helps investors make informed decisions by providing them with a comprehensive view of market developments, company performance, and industry trends.

Types of Pre-Market Data

Pre-market data comes in various forms, including:

Earnings Reports: Quarterly earnings reports from publicly traded companies that provide insights into their financial performance.

Order Flow Data: Real-time data on market orders and trades, helping investors track market sentiment and identify potential trends.

Sector Performance Data: Insights into the performance of various sectors and industries, allowing investors to make informed decisions about specific stocks or markets.

How to Utilize Pre-Market Data

To get the most out of pre-market data, investors should:

Familiarize themselves with the different types of pre-market data available and their relevance to their investment goals.

Develop a strategy for analyzing and interpreting pre-market data, taking into account market trends, company performance, and industry developments.

Stay up-to-date with the latest market news and developments to stay ahead of the curve.

In conclusion, pre-market data is a valuable resource for investors seeking to gain a competitive edge in today's fast-paced financial markets. By providing timely insights into market trends, company performance, and industry developments, pre-market data helps investors make informed decisions and reduce their exposure to market volatility.

As the financial landscape continues to evolve, the importance of pre-market data is only likely to grow. For investors seeking to stay ahead of the curve, having access to accurate and timely pre-market data can be a game-changer.